The Eternity of Wealth

The concept of infinity is present in everyday life in various ways, such as when looking at the horizon, the sky, or in reflections about the past, or in the very existence of things. In planning their lives, people often lack a sense of finitude, despite being aware that life is finite and will ultimately come to an end.

The concept of “Infinity” has always intrigued humanity and has been the subject of study by many scholars and philosophers throughout human civilization. Historically, debates about infinity predate Plato and Aristotle, and they have been a constant in the schools of Greek thought. However, due to their complexity, they were avoided until the Renaissance, in the fifteenth century, when the discussion about infinity resurfaced. Still, it was only thoroughly studied during the nineteenth and twentieth centuries.

In nature, an intriguing species of jellyfish appears to have discovered a way to defy natural death, managing to evade the inevitable. In general, jellyfish undergo rapid aging after reaching sexual maturity and reproducing, but not Turritopsis Nutricula.

According to scientists, if subjected to stress conditions and incredible danger, members of the species can spontaneously reverse their adult condition back to the way they were when they were young, essentially the first stage of the life cycle of the jellyfish species (which is a polyp, or a fixed tube with anemone-like tentacles). The species changes its existing cells, which can replicate and mutate into other cells when the adults reproduce again, much like human stem cells.

After reverting to their younger condition, jellyfish return to the adult form, and the process can be repeated infinitely. Humans also possess the capacity to renew, return to zero, and start anew. Companies often need to restructure, revise their strategy, restore, and change.

Among the models of business formation, the Corporation is the one that best expresses the concept of infinity in human relations. By law, the duration of an association in the form of a Corporation can be “forever”. It has an unlimited duration, as it is distinct from its owners, and the death or withdrawal of a shareholder does not affect the company’s existence; it can continue even after the withdrawal of its original owners. This concept should be reflected in the monetary valuation of a company, since it can generate perpetual returns; in other words, it can theoretically provide a perpetual source of profits.

In company valuation methodologies, the concept of Perpetuity is one of the components that most confuses readers of valuation reports and financial articles, especially regarding the calculation methods.

In the Discounted Cash Flow Methodology, the value of the company is composed of the present value of cash flows generated by the company, divided into two periods in the future: the period corresponding to the long-term planning of the company, typically 5 to 10 years, and the perpetuity period. As the generation of cash for a company is theoretically infinite and, therefore, part of the enterprise value, referred to as the value of perpetuity, it will be generated by a constant series of cash flows from the years following the last year of its long-term planning period. To get an idea, in some cases, the value of perpetuity may represent the most significant portion of the total value of the company (Enterprise Value). It can be a challenging task for some people to abstract a concept as intangible as eternity and convert it into a simple mathematical calculation, especially for those who wish to acquire a company (or any asset) and pay a significant portion of its value for it.

In general, the formula for the Present Value of a series of limited cash flows corresponds to:

Thus, the formula for the present value of perpetual cash would be the sum of infinite terms of the present value formula expressed above. Thus, calculating countless “Present Values” would be impractical for an infinitely long series. The series, as presented above, are called Geometric Progressions, which, despite having an infinitely large number of terms, have a finite sum.

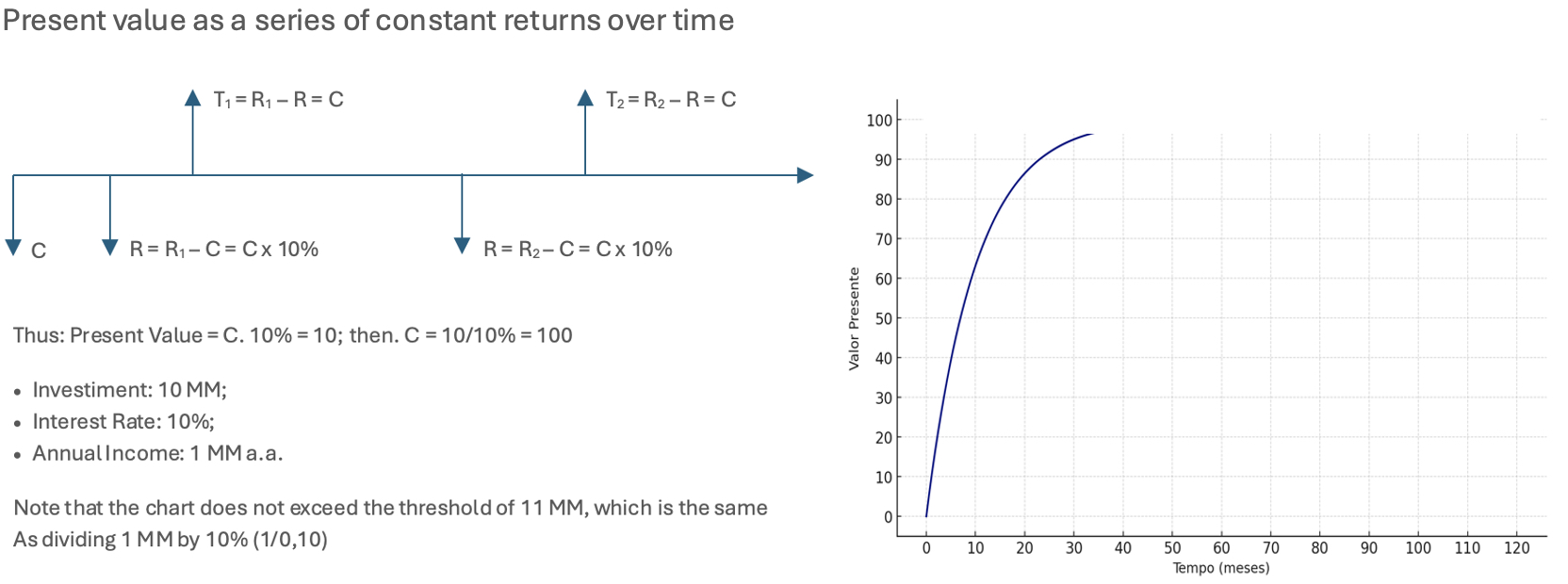

Nevertheless, the calculation of perpetuity can be easily understood intuitively by means of a chart or algebraically. Imagine an investment C, which will yield R income annually, and that the investor wants to take from his investment, annually, the value of R. Now, let’s say the investor knows he intends to withdraw annually 1 MM and the interest rate on the investment is 10%, how much would he need to invest to obtain R (R = 1 MM) annually?

As R = C x 10%, then C = R / 10%; therefore, C is equal to 10 mm. Note that if we applied an amount equal to 10% of the income to the 10% income tax, we would see that the pay would be equal to R, since: (R / 10%) x 10% = R.

In the projection of perpetuity, we see that the flows will be constant and equal, and only as such would it be possible to apply the above. However, there are cases where the income in each period has continuous growth. The idea is that the cash flow of the subsequent years (that makes up each year in perpetuity) will unlikely be without growth, given that there will at least be inflation. In such cases, the simplified formula for the present value of perpetuity is similar to the previous case, but inflation is subtracted from the rate of growth.

Thus, C = R / (10% (-) growth rate). Note that the growth rate cannot exceed the value of the discount rate, since the division would not be possible.

In cases of Mergers and Acquisitions, it is common for analysts using the Discounted Cash Flow methodology to calculate perpetuity without neglecting the constant growth rate, which is at least the perpetual inflation rate, corresponding to the projected inflation rate for the country in which the company operates.

If the reader thinks that perpetuities are irrelevant in reality, there is a well-known cash flow with infinite duration: the so-called British obligations referred to as consols. An investor who buys a consol is entitled to receive annual interest from the British government for an indefinite period. A similar case was the issuance of U.S. bonds for the construction of the Panama Canal, but the U.S. government chose to repay the entire amount after some time. Preferred shares issued by companies in the stock market are another example: if there were no doubt that the company would actually pay the dividend for the preferred shares, such shares would, in fact, be a consol.

Consols are obligations that never stop paying a coupon, have no maturity date, and therefore never mature. Thus, a consol is a perpetuity. In the eighteenth century, the Bank of England, which held various debt securities, decided to consolidate these securities into a single one, which became known as English consols. They were obligations, which, according to the guarantee of the Bank of England, would give the bearer an infinite cash flow.

João Eliezer Cunha Guimarães is a partner at Camaya Partners.

Vinícius Basílio has contributed to this article.